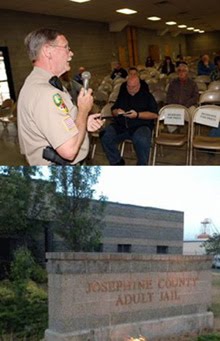

Josephine County Budget Deficit, Tax Levy Defeat

Updated 7-23-13

Josephine County Tax Levy Defeat has heralded grave consequences by officials of the county, but should this truly be the case?

Josephine County Tax Levy Defeat has heralded grave consequences by officials of the county, but should this truly be the case?While my opinion is likely not going to be taken seriously as it never is in Josephine County (as a few friends/supporters have noted the similarity of my situation to the Bible book of Mark, 6:4-6), despite my years of business success and well regarded skills in organizational management.

I will give my suggestions anyway and hopefully some honest county commissioner will read these suggestions.

I will also state that I find the local media coverage insulting to me and especially to those who literally could not afford this property tax increase without the REAL danger of losing their home!

In fact while the decision to vote NO on the ballot measure for a tax levy to keep staffing for the Sheriff department was probably the most difficult voting decision I have ever made, the main factor in voting NO (I was originally leaning toward a yes vote) was the many people I knew of that would have the real risk of losing their home due to this tax increase.

For me, my financial situation is much improved over a few years ago (although I still have debts from this period due to situations beyond my control).

HOWEVER my feeling was and is; What right do I or others have to potentially force others to loose their home just because I can afford to pay this tax???

This brings me to my points to keep current staffing or even improve staffing for our important county services such as the Sheriff and Road department:

| Update 5/22/13 The latest measure to fund the jail and sheriff went down to defeat 51 percent to 49 percent. While I will admit I voted yes this time, I certainly respect the reasons many I know who voted no. Again, lack of good County Management (including from those inside the county government) was one of the major reasons cited. As well lack of accountability of the funds generated by this measure was cited by others I talked to. Sadly, few if any of the ideas I put forth a year ago were considered, but then that is not a surprise either. Please read these suggestions after this update |

- Since I know for a fact that many have asked to volunteer payment of this tax to keep staffing, yet it was refused due to lack of a way to accept this money; this MUST BE CHANGED!

This should be administered similar to a pledge so that reasonable planning of funds can be done by county commissioners/staff.

In other words someone would pledge say $25 per month ($300 per year) and a form could be filled out or better; an automatic credit/debit card, or bank account could be drafted (even PayPal could be used).

This would also allow for those willing/able to pay more to do so which may make up for the many who cannot pay much or anything. - Fee for service;

As with Rural Metro Fire, a fee for service can be imposed, which includes a sliding scale for those who abuse police/sheriff services with many more than normal calls, especially for often minor issues.

This could be mixed with the voluntary "pledge" i noted above where-by a pledge of say $25 or more per month (that is kept current) does not pay anything for services. - County Parks use fee;

As someone who loves and uses our parks for camping, I personally think most all parks should be self sustaining, just as a Private RV Park must be.

If not, the use fees should be higher.

While I am not for big government of a fee for this and a fee for that, why should someone subsidize my camping anymore than I should be expected to subsidize their activities?

An example would be to have county run movie theaters where the county tax payers subsidize the shows, regardless of whether or not every tax payer utilizes the facility.

Also, as pointed out by a friend and co-worker, sometimes (as with business) finding the "sweet spot" in a fee is also important.

An example of what I am referring to is the fee to play Frisbee golf, where-by she stated that she finds the fee too much for an hour of Frisbee golf, but would pay this fee it were lower. - Road Use Fees;

While this may require State approval, charging say $.02 per gallon of gas at all county gasoline stations may help offset county road maintenance costs.

This again is a "use tax" where-by those who due not drive and use a gasoline or diesel powered vehicle can avoid this tax by simply not driving.

I know California has similar taxes, although often these funds are raided for other uses, which must be avoided by correct legal terminology if this means of revenue generation is used. - Since I operate a business within the Grants Pass city limits;

See: American Aquarium Products

I pay a business tax and while many business taxes (such as gross revenue taxes) are oppressive and anti business, a reasonable tax similar to the Grants Pass tax (maybe a bit less though) would help with budget deficits.

I would also add that businesses by nature use more city or county services such as roads, fire, police and thus this too can be looked at as a user fee assuming it is applied reasonably and not oppressively - Cut the County Commissioners pay

This idea is not one I thought of, but it has been proposed and certainly is a good one that may not help a lot on its own, but taken with other ideas I already suggested, it should be "part of the mix" - Necessary Services?

In looking over the county's online business statements it caught my eye that Health Services was the second largest expenditure; WHY?

While I did not dig deeply, I could not find any up-front explanation of what this money was used for.

My personally opinion is that health services is often a cash cow for oppressive and unconstitutional government agencies such as the Oregon DHS.

Whether this is the case here with Josephine County, I do not know, but the answer is also not readily found

See: Oregon DHS, Abuse of Authority

I feel VERY STRONGLY that taken in part or together that these can and will work and may even have the potential of generating MORE revenue than Josephine County previously had with the Federal Timber payments and property taxes.

HISTORY BEHIND THIS TAX SHORTFALL

For decades, Josephine, Curry, and other Oregon timber counties relied on millions in federal timber sales to pay for sheriff's deputies, jails, roads, prosecutors, health clinics and other services.

Federal land makes up 60 percent of the land base in counties such as Josephine County Oregon, but isn't subject to property taxes. So the federal government shared harvest revenue with these counties.

However the near shut-down of logging on federal forests due to extremist environmentalist concerns cost these counties dearly.

Congress in 2000 approved a payment program to replace the timber money, and extended it twice, but this was not renewed this past year.

By Carl S.

Labels: Budget Deficit, Grants Pass, Josephine County, Road Maintenance, Sheriff, Tax Levy Defeat, Tax Revenue

Ultraviolet Sterilization, THE AQUARIUM & POND UV AUTHORITY"

Ultraviolet Sterilization, THE AQUARIUM & POND UV AUTHORITY"

Unique information about Grants Pass Oregon

Unique information about Grants Pass Oregon